Bond compound interest calculator

To compute compound interest we need to follow the below steps. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

Simple Interest Calculator Bonds Notes Mathematics For The Liberal Arts Corequisite

Treasury savings bonds pay out interest each year based on their interest rate and current value.

. Interest is compounded semi-annually throughout the duration or at the end of each fraction of a half-year for any fractional years. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. More Calculators on the Site.

This simple to use Excel spreadsheet includes a table showing the interest earned each year. Savings bonds are issued by the US. Interest paid in year 1 would be 60 1000 multiplied by 6 60.

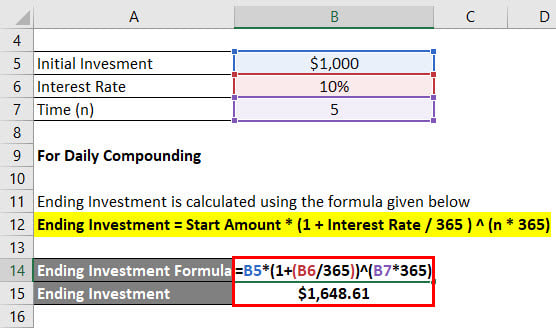

A 6 year bond was originally issued one year ago with a face value of 100 and a rate of 6. The converged upon solution for the yield to maturity of the. Daily Compound Interest Formula Example 2.

Include regular monthly deposits andor an annual deposit. P1 RNNT A. P is the investment or principal balance at the start of.

At the end of three years simply add up each compound interest calculation to get your total future value. Some forms of lending may also be subject to compound interest including some credit cards and loans meaning youll owe interest on the interest youve previously accrued. As a bond purchaser or bondholder you are compensated for your investment in the form of interest which is added to the value of the bond according to various schedules eg.

The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or other financial product due to the result of. You just bought the bond so we can assume that its current market value is 965. Thought to have.

Lets go over the compound interest formula and define each of the variables. A unique feature of this calculator is the option to select a random interest rate to simulate fluctuation in the market. Input 10 PV at 6 IY for 1 year N.

To illustrate why bond prices and market interest rates tend to move in opposite directions. Compound interest doesnt just apply to growing your money. As the prior example shows the value at the 6 rate with 5 years remaining would be 7473.

After a user enters the annual rate of interest the duration of the bond the face value of the bond this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Think of this as twelve different compound interest calculations one for each quarter that you deposit 135. The formula would be shown as.

Future Value Compound Interest EMI Calculator. It is the basis of everything from a personal savings plan to the long term growth of the stock market. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button.

Pressing calculate will result in an FV of 1060. Find out the initial principal amount that is required to be invested. Treasury and reliably build value over time.

The bond pays out 21 every six months so this means that the bond pays out 42 every year. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. Yield to Maturity.

My father loans me 2000 to buy a used car and tells me I need to pay it off in one big chunk a balloon. It is possible to see this in action on the amortization table. Estimate the interest earned in your savings account.

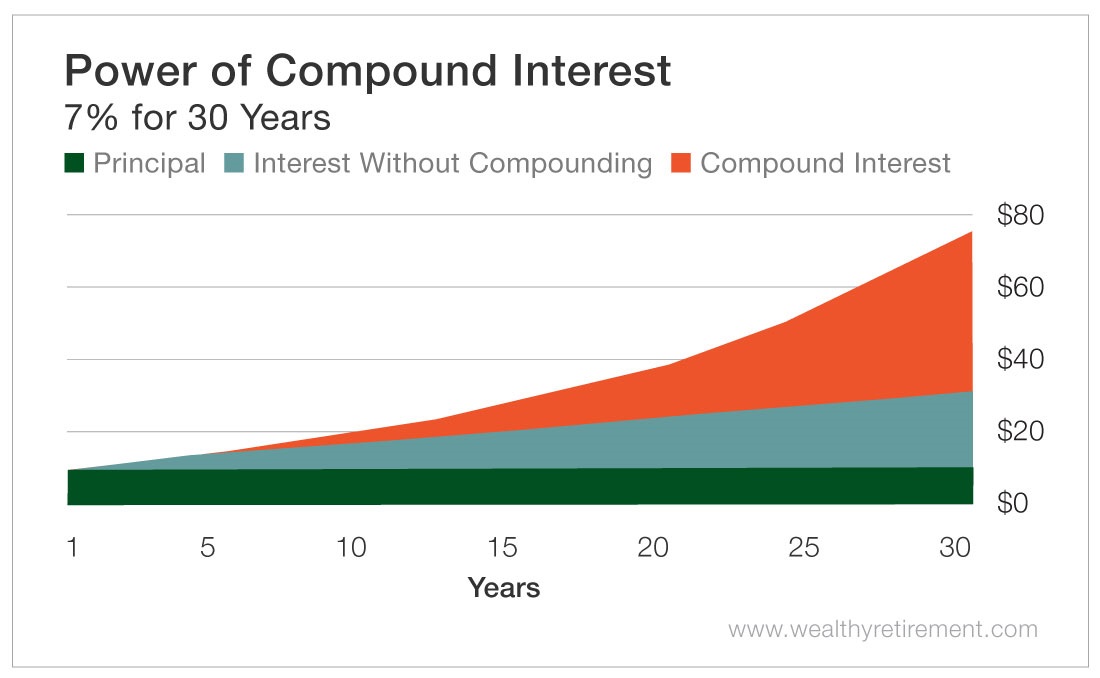

Typically cash in a savings account or a hold in a bond purchase earns compound interest and so has a different value in the future. How to repay debts. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Our compound interest calculator above limits compounding periods to 100 within a year. Bond Face ValuePar Value - The face value of the bond also known as the par value of the bond. We can ignore PMT for simplicitys sake.

Compound Interest Present Value Rate of Return Annuity Present Value of Annuity Bond Yield Mortgage Retirement. Current Bond Trading Price - The price the bond trades at today. If youre interested in whats going on behind the scenes see How Finance Works for interactive graphs that illustrate present and future values annuities mortgages bond yields and more.

Daily Compound Interest 61051 So you can see that in daily compounding the interest earned is more than annual compounding. Compound Interest Explanation. Compound interest is a powerful concept and it applies to many areas of the investing world.

Assume that you own a 1000 6 savings bond issued by the US Treasury. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Bond YTM Calculator Outputs.

Try using the above calculator to solve the example problems listed below. Years to Maturity - The numbers of years until bond maturity. Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases.

You have a savings account that earns Simple InterestUnlikelyMost savings accounts earn compound interest. You can learn more about supercharging your retirement savings. A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed.

It is possible to use the calculator to learn this concept. Effective Annual Interest Rate. In this example we suppose that the interest rates have changed to 5 since it was originally issued.

Simple Interest Example Problems. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. The current market price of the bond is how much the bond is worth in the current market place.

That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period. Calculate interest compounding annually for year one. Yield to Maturity Calculator Inputs.

Compound Interest Definition Formula How It S Calculated

Compound Interest Calculator Daily Monthly Quarterly Annual

Simple Interest Calculator Audit Interest Paid Or Received

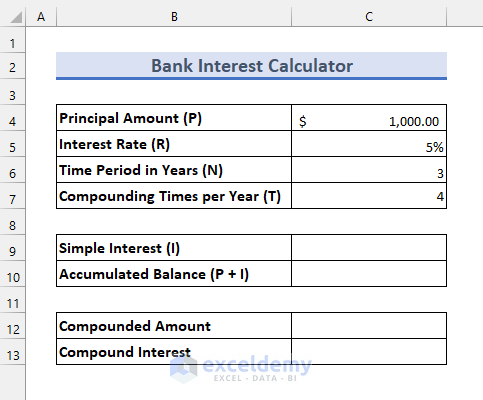

Bank Interest Calculator In Excel Sheet Download Free Template

Compound Interest Formula With Graph And Calculator Link

Daily Compound Interest Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula And Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator Set Your Own Compounding Periods

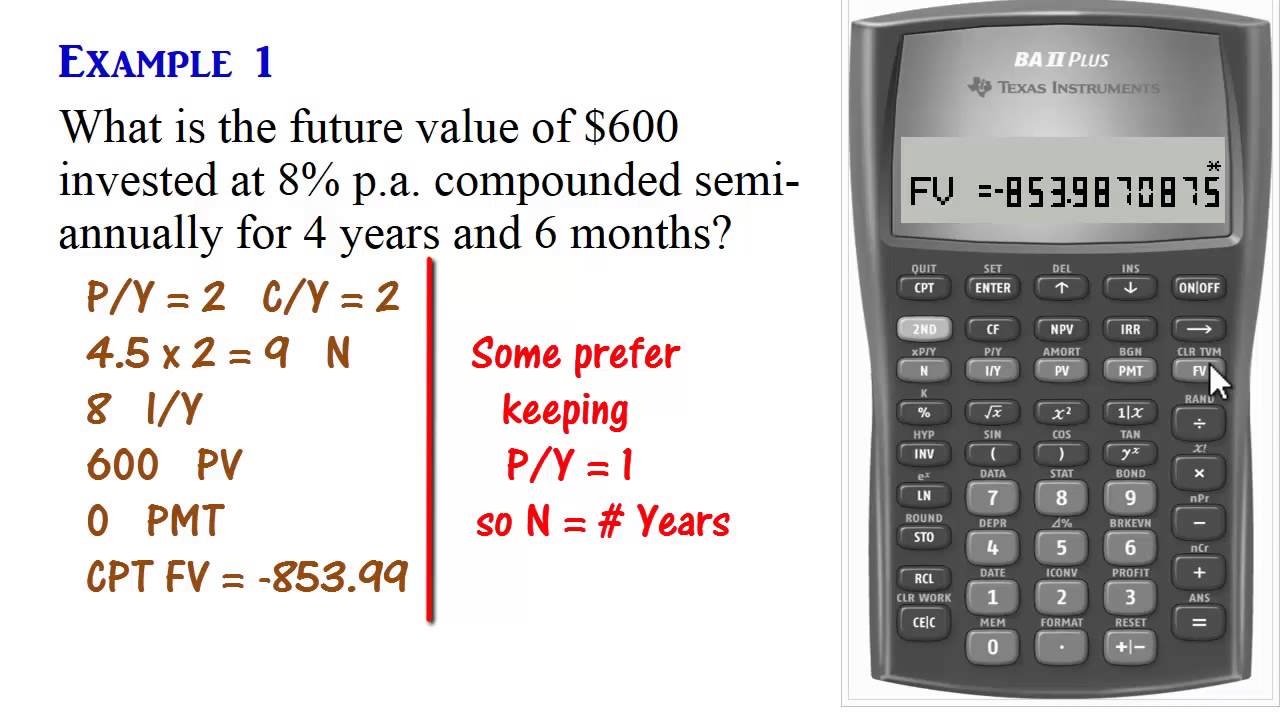

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

Zero Coupon Bond Formula And Calculator Excel Template

Compound Interest Formula With Calculator

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula And Calculator Excel Template

Compound Interest Formula And Calculator Excel Template